My powerpoint presentation about Accounting Principles!

Hi people! I would appreciate it if you could check out my prezi presentation about the British Economy!

To start thing off, ‘Inflation’ – it’s a word that’s often mentioned and seldom understood. Most of us know the basics; we understand that inflation affects the price of food, goods and services in a country. But few of us really know what inflation is, what causes it and how we can prepare for the effects of it.

To start thing off, ‘Inflation’ – it’s a word that’s often mentioned and seldom understood. Most of us know the basics; we understand that inflation affects the price of food, goods and services in a country. But few of us really know what inflation is, what causes it and how we can prepare for the effects of it.

Inflation is the long term rise in the prices of goods and services caused by the devaluation of currency. While there are advantages to inflation which I will discuss later in this article, I want to first focus on some of the negative aspects of inflation.

Inflationary problems arise when we experience unexpected inflation which is not adequately matched by a rise in people’s incomes. If incomes do not increase along with the prices of goods, everyone’s purchasing power has been effectively reduced, which can in turn lead to a slowing or stagnant economy.

One such theory suggests that in fast growing economies, inflation is created by a general increase in supply and demand for goods and services, resulting in prices being increased. Simply put, the more demand there is, the more people are willing to pay.

In the developed world, another theory argues that rising costs for companies results in higher prices for their products. This happens because, in general, most companies want to maintain their profit margins in order to sustain their business.

Another generally accepted theory relates to the supply of money in an economy. If we consider money as a commodity, then, by the mechanism of supply and demand, we can reason that the oversupply of money in an economy weakens its value, thus reducing its purchasing power. Put simply, more money in circulation causes prices for goods and services to rise.

There’s nothing we can do to stop inflation. You can, however, learn to manage your finances better so that you are always in a position to handle inflation. The first thing to do is ensure that you save properly and set aside a little nest egg that you can make use of when prices increase. Having an emergency fund will help ensure that you aren’t completely stretched when the costs of living rise.

The next thing you need to do is tackle your debt. Make sure that you have paid off any outstanding debts if possible and that you are constantly looking to improve your credit score. A good credit score means that you will be able to apply for credit (such as an emergency loan) if need be.

The last thing to consider is your budget. If you’ve already set up your budget, you need to have another look at it. Where can you cut your spending each month and save a little extra? Ensure that you spend only what you need to and that you exercise the discipline to stick to your budget. That way, you can put any leftover money straight into your savings (your emergency fund, for example), where it can sit until you really need it.

Like it or not, inflation is real. Ignoring the effects that inflation can and will have on your long-term savings is probably one of the biggest mistakes that many investors make. Understanding the detrimental causes and effects of inflation is the first step to making long-term decisions to mitigate the risks. But the next step is taking action. Consider the ten tips above to help you overcome the devastating effects inflation can have on your future retirement.

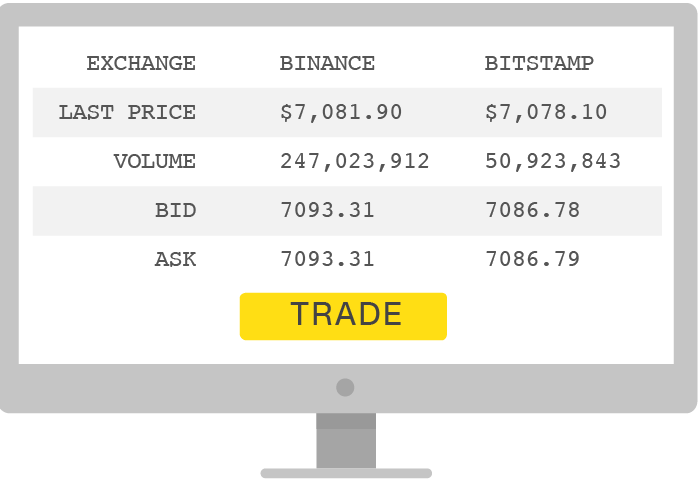

Bitcoin is a cryptocurrency created in 2009. Marketplaces called “Bitcoin exchanges” allow people to buy or sell Bitcoins using different currencies.Bitcoin is a new currency that was created in 2009 by an unknown person using the alias Satoshi Nakamoto. Transactions are made with no middle men – meaning, no banks! Bitcoin can be used to book hotels on Expedia, shop for furniture on Overstock and buy Xbox games. But much of the hype is about getting rich by trading it. The price of Bitcoin skyrocketed into the thousands in 2017.![]()

Bitcoins can be used to buy merchandise anonymously. In addition, international payments are easy and cheap because Bitcoins are not tied to any country or subject to regulation. Small businesses may like them because there are no credit card fees. Some people just buy Bitcoins as an investment, hoping that they’ll go up in value.

Many marketplaces called “Bitcoin exchanges” allow people to buy or sell Bitcoins using different currencies. Coinbase is a leading exchange, along with Bitstamp and Bitfinex. But security can be a concern: Bitcoins worth tens of millions of dollars were stolen from Bitfinex when it was hacked in 2016. The most spectacular theft was revealed in February 2014 when Mt. Gox, which had been the world’s third largest Bitcoin exchange, declared bankruptcy because of the theft of about 650,000 Bitcoins, then valued at about $380 million.

People can send Bitcoins to each other using mobile apps or their computers. Users transferring the coins sign with their private keys, and the transaction is then transmitted over the Bitcoin network. So that no Bitcoin can be spent more than once at the same time, the time and amount of each transaction is recorded in a ledger file that exists at each node of the network.

People compete to “mine” Bitcoins using computers to solve complex math puzzles. This is how Bitcoins are created. The difficulty of the problem is adjusted so that, no matter how many people are mining Bitcoins, the problem is solved, on average, six times an hour. Currently, a winner is rewarded with 12.5 Bitcoins roughly every 10 minutes.

Bitcoins are stored in a “digital wallet,” which exists either in the cloud or on a user’s computer. The wallet is a kind of virtual bank account that allows users to send or receive Bitcoins, pay for goods or save their money. Unlike bank accounts, Bitcoin wallets are not insured by the FDIC.

The value of Bitcoins relative to physical currencies fluctuated wildly in the years following its introduction. In August 2010 one Bitcoin was worth $0.05 (U.S.). Beginning in May 2011, the Bitcoin increased sharply in value, reaching a peak of about $30 that June, but by the end of the year the value of a Bitcoin had collapsed to less than $3. However, Bitcoin began to attract the attention of mainstream investors, and its value climbed to a high of over $1,100 in December 2013. Some companies even began building computers optimized for Bitcoin mining.

No one knows what will become of Bitcoin. It is mostly unregulated, but some countries like Japan, China and Australia have begun weighing regulations. Governments are concerned about taxation and their lack of control over the currency.

Thanks for joining me!

Good company in a journey makes the way seem shorter. — Izaak Walton